Having a pool in your backyard is a dream come true for many homeowners. But what happens to your homeowners insurance if you don’t have a fence around your pool?

You might be surprised to learn how much this simple detail can affect your coverage and costs. If you want to protect your home, your wallet, and your peace of mind, understanding the connection between a pool with no fence and your insurance is crucial.

Keep reading to discover what you need to know to stay safe and avoid costly surprises.

Risks Without A Fence

Having a pool without a fence can create serious risks for homeowners. Pools are fun but also dangerous without proper barriers. A fence helps keep people safe and reduces many problems. Without a fence, you face several important risks that affect your safety and insurance.

Liability Concerns

Without a fence, anyone can enter your pool area. This increases your chance of being responsible for accidents. If a child or visitor gets hurt, you may face legal trouble. Liability claims can lead to high costs and stress. A fence lowers your liability by controlling access to the pool.

Increased Accident Risks

Pools without fences have a higher risk of accidents. Children or pets might fall into the water unnoticed. Drowning accidents happen more often in unfenced pools. Accidents can cause serious injury or death. A fence acts as a safety barrier to stop accidents before they happen.

Property Damage Exposure

Without a fence, your pool area is open to damage. Animals, trespassers, or weather can harm your property. Broken pool equipment and other damage may cost you a lot. Insurance claims might not cover all damage if no fence exists. A fence helps protect your pool and property investment.

Credit: guardianpoolfence.com

Insurance Coverage Basics

Homeowners insurance helps protect your house and belongings. Having a pool without a fence changes some risks. Understanding insurance coverage basics is key. This section explains what standard policies cover and what limits apply. It also highlights exclusions to watch for in your policy.

Standard Policy Protections

Most homeowners insurance covers damage to your home from fire, storms, or theft. It also protects personal property inside your house. Some policies include coverage for temporary living costs if your home is unlivable. Pools without fences increase risk, so insurers may require extra care. Check if your policy covers pool-related accidents or damage.

Liability Coverage Limits

Liability coverage protects you if someone is hurt on your property. Pools without fences can raise the chance of accidents, making liability coverage important. Policies have limits on how much they pay for injury claims. Make sure these limits are high enough to protect your savings. Ask your agent about increasing liability coverage if you have a pool.

Exclusions To Watch For

Some policies exclude certain risks related to pools without fences. For example, injuries from unattended pools may not be covered. Damage caused by floods or earthquakes is often excluded. Read your policy carefully to spot these exclusions. Understanding what is not covered helps you avoid surprises after a claim.

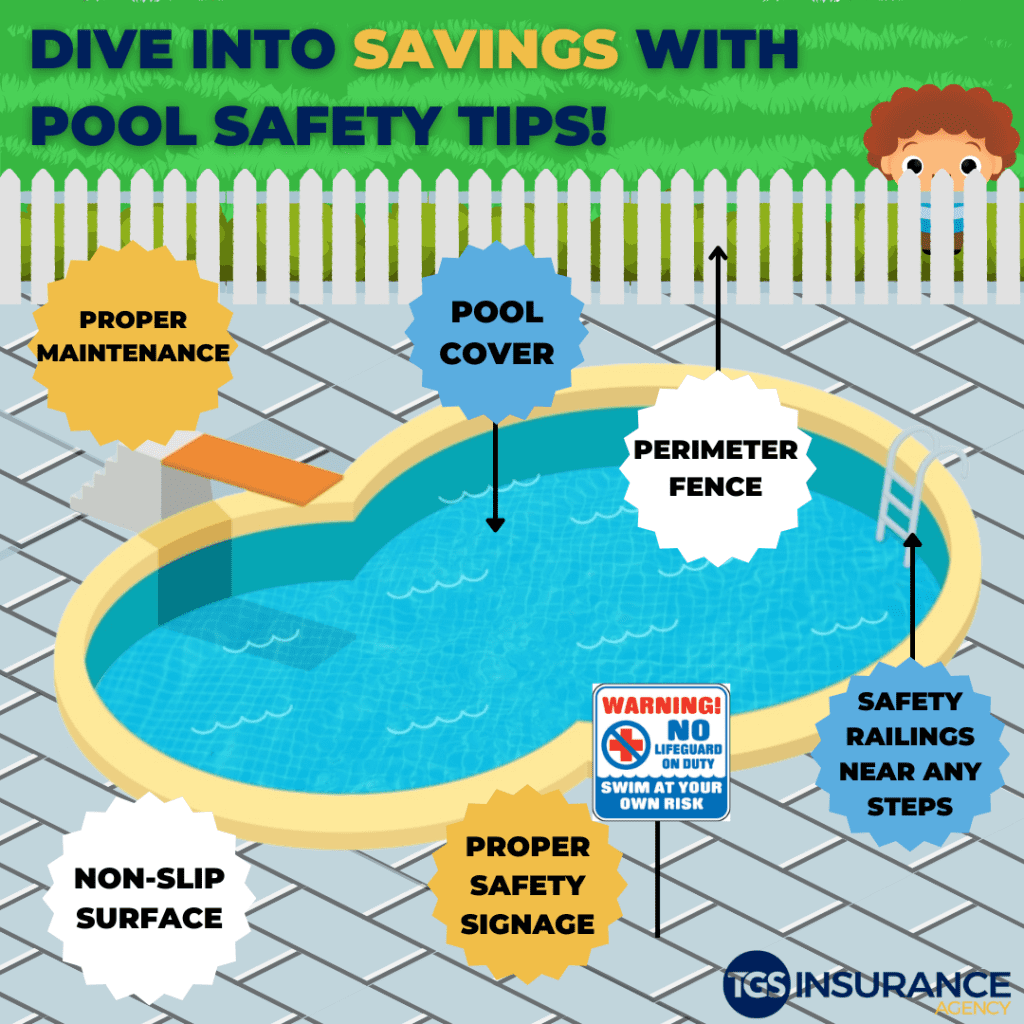

Safety Measures Around Pools

Pools bring fun and relaxation to any home. They also bring risks, especially without fences. Safety measures help protect children and pets. They reduce accidents and provide peace of mind. Simple steps can make a big difference.

Installing Pool Alarms

Pool alarms alert you if someone enters the water. They sound a loud noise to warn nearby adults. Some alarms detect water movement or pressure changes. Installing alarms adds an extra safety layer. It is helpful when no fence surrounds the pool.

Using Safety Covers

Safety covers block access to the pool. They prevent accidental falls into the water. Covers are strong and can hold weight. Use covers whenever the pool is not in use. They act as a barrier and keep children safe.

Supervision And Signage

Constant supervision is the best protection. Always watch children near the pool area. Teach them pool rules and dangers. Place clear signs that warn about risks. Signs remind everyone to stay alert and careful.

Enhancing Policy Protection

Homeowners with a pool but no fence face unique risks. Enhancing policy protection is key to managing these risks well. It helps reduce liability and protects your finances. Understanding the options available can make a big difference.

There are several ways to improve your insurance coverage. Each method strengthens your protection against accidents or damage related to your pool area.

Adding Umbrella Insurance

Umbrella insurance offers extra liability coverage. It extends beyond your regular homeowner policy limits. This is helpful if an injury at your pool leads to large claims. Umbrella policies cover legal fees and damages above your main policy.

This extra layer of protection provides peace of mind. It helps cover costly lawsuits or serious accidents. Many homeowners choose umbrella insurance for pools without fences.

Homeowner Policy Endorsements

Endorsements are additional coverages added to your policy. You can tailor your insurance to fit risks from a pool with no fence. Common endorsements include liability increases or accidental injury coverage.

They allow more specific protection for swimming pool hazards. Discuss possible endorsements with your insurer to find suitable options. These changes can improve your policy’s response to pool-related incidents.

Documenting Safety Features

Documenting your pool’s safety features helps reduce insurance risks. Keep records of alarms, covers, or non-fence barriers you use. Photos and receipts prove you take safety seriously.

Insurance companies may offer discounts for documented safety measures. Good records support your claim if an accident occurs. They show your commitment to preventing pool accidents.

Legal Responsibilities

Owning a pool without a fence comes with serious legal duties. These rules protect people, especially children, from accidents. Understanding these responsibilities helps avoid trouble and keeps your home safe.

Local Pool Safety Laws

Each area has rules about pool safety. Many places require fences or barriers around pools. These laws aim to prevent accidental drownings. Knowing your local laws helps you follow the right safety steps.

Check with city or county offices for specific rules. Some areas have strict penalties for ignoring pool safety laws. Staying informed is your first step to legal compliance.

Neighbor Liability Issues

Without a fence, neighbors might worry about safety. If someone gets hurt in your pool, you could be legally responsible. This includes visitors and even neighbors’ children.

Liability means you might pay for injuries or damages. Carrying proper insurance helps protect your finances. Open pools increase risks and potential legal claims.

Compliance And Penalties

Failing to meet pool safety laws can lead to fines. Authorities can require you to add fences or safety devices. Ignoring these orders may result in higher penalties or legal action.

Following safety rules avoids fines and protects your family. Proper compliance shows you care about safety and legal duties.

Credit: poolguardusa.com

Cost Implications

Owning a pool without a fence affects your homeowners insurance costs. Insurance companies see pools without fences as higher risks. This can lead to changes in your insurance premiums and potential claim costs. Understanding these cost implications helps you make better decisions.

Premium Variations Without Fence

Insurance premiums often rise if your pool lacks a fence. Insurers view unfenced pools as dangerous, especially for children. The risk of accidents increases, which can mean higher costs for you. Some companies may even refuse coverage without proper barriers. Shop around to find the best rate if you have no fence.

Potential Claim Costs

Claims related to pool accidents can be costly. Without a fence, the chance of injury or drowning is higher. This can lead to expensive medical claims and legal fees. Your insurer might increase your premium after a claim. Preventing accidents with a fence reduces these risks and costs.

Balancing Safety And Expenses

Installing a fence adds initial costs but lowers insurance premiums. It also protects your family and neighbors. A fence reduces accident risks and claim chances. This balance of safety and expenses saves money over time. Consider fencing as an investment in safety and lower insurance costs.

Credit: tgsinsurance.com

Frequently Asked Questions

What Happens To Insurance Without A Pool Fence?

Insurance may cost more or exclude pool-related accidents without a fence.

Does A Pool Fence Lower Homeowners Insurance Premiums?

Yes, many insurers offer discounts for having a secure pool fence.

Are Pool Fences Legally Required For Homeowners Insurance?

Laws vary, but many areas require pool fences for insurance coverage.

How Does A Pool Fence Reduce Insurance Risks?

Fences help prevent accidents by keeping children and pets away from pools.

Can Insurance Deny Claims If No Pool Fence Exists?

Claims may be denied if accidents happen and no fence was installed.

What Types Of Pool Fences Does Insurance Prefer?

Sturdy, climb-resistant fences with self-closing gates are usually preferred by insurers.

Conclusion

Having a pool without a fence can affect your insurance costs. It raises the risk of accidents and injuries. Your insurer may charge higher premiums or add restrictions. Installing a fence helps protect your family and lowers risk. It can also make your home safer and more secure.

Always check your policy details carefully to avoid surprises. Staying informed helps you make smart choices for your property. Safety and savings go hand in hand with proper pool protection.